Background

The ERISA Section 103(a)(3)(C) Audit is one of the more common types of audits performed over a 401(k) or employee benefit plan. As part of the audit, management of the 401(k) or employee benefit plan must determine if the ERISA Section 103(a)(3)(C) audit is permissible by obtaining and inspecting a certification from a qualified institution stating the investment information of the 401(k) or employee benefit plan is complete and accurate. A qualified institution is defined as:

A bank or similar institution or insurance carrier that is regulated, supervised, and subject to periodic examination by a state or federal agency in accordance with 29 CFR 2520.103-5 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA.

Two common questions management often has when inspecting the certification are; 1) Can the plan sponsor accept a certification from the plan’s recordkeeper if the recordkeeper certifies the investment information to be complete and accurate on behalf of the plan’s qualified institution (for example, trustee, custodian, or insurance entity) as “agent for”? And 2) Is it permissible to perform an ERISA Section 103(a)(3)(C) audit on a portion of the plan’s investments but not all (some investments did not meet the DOL 29 CFR 2520.103-8 criteria to be certified)?

Question 1 Response

Yes, a certification provided as “agent for” the 401(k) or employee benefit plan’s qualified institution generally would be acceptable when there is a contractual arrangement between the qualified institution and the “agent for”. It is important that a contractual agreement exists between the qualified institution and the entity that is acting as its agent to support the existence of the “agency” relationship and that plan management retain documentation of the contractual agreement.

Question 1 Audit Impact

When an agency relationship exists, the 401(k) or employee benefit plan auditor is likely to request such documentation and have plan management include a written representation to support the existence of an “agency” relationship at the conclusion of the audit. Additionally, the 401(k) or employee benefit plan auditor may also want to revise the “Scope and Nature of the ERISA Section 103(a)(3)(C) Audit” portion of the report to include a reference to such arrangement. However, the agency relationship itself generally would not impact the opinion issued by the 401(k) or employee benefit plan auditor.

Question 2 Response

Yes, it is permissible to perform an ERISA Section 103(a)(3)(C) audit when only a portion of a plan’s investments have been certified.

Question 2 Audit Impact

In that case, the 401(k) or employee benefit plan auditor should perform audit procedures on the investment information that has not been certified. The 401(k) or employee benefit plan auditor’s report is the same as that used for an ERISA Section 103(a)(3)(C) audit. However, the note to the financial statements that is referenced in the “Scope and Nature of the ERISA Section 103(a)(3)(C) Audit” section in the auditor report should clearly identify the investments that were certified.

Thanks for reading!

1 Comment

Dear K Financial

Does your business need an outbound sales cadence to help maintain a healthy sales funnel and generate new leads?

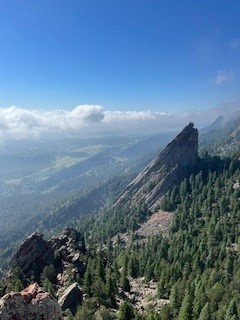

My name is Jessica from Colorado, respectfully inquiring

whether your business needs a system in place to help you get new business. This is not SEO, email marketing, cold

calling, social media, or SMS blasts. Instead we focus on messaging your prospects directly on their website. This is different and it’s working for our clients.

Let us help you start conversations with THOUSANDS of prospective clients and/or referral partners on your behalf, thus maintaining a healthy sales funnel active this year and beyond.

Pick a cadence, start conversations, get new business! If

interested, please reply back to schedule a brief intro call

to see if we are a good fit for you.

Happy New Year!

Jessica S.

OutboundCadence.com

(720) 295-4784