Preparing your company and plan for its first 401(k) audit can be a tedious task, but with the right knowledge and tools you can help prepare for a successful and smooth audit.

When will my Plan require an audit?

The Employee Retirement Income Security act of 1974 (ERISA) requires that plan financial statements be audited by an independent auditor once a plan has more than 100 eligible participants at the beginning of the plan year. The exception to this rule is the “80-120 rule” which allows for smaller organizations to avoid the audit requirement to focus on growth. If you have between 80 and 120 eligible participants and have historically been considered a small plan (filed a 5500 short form), you are eligible to continue filing a short form until such time that the plan exceeds 120 participants at the beginning of the plan year. Once the plan exceeds 120 participants, you will be required to file as a large plan. Once this requirement has been triggered you’ll be required to continue filing as a large plan as long as you have 100 or more participants as of the beginning of each plan year.

What does the audit entail?

401(k) plan audits are different from a traditional financial statement audit that you may have experienced because the audit of the plan isn’t solely focused on financial reporting, but also on compliance and adherence to DOL and IRS regulations. Your auditor will assess the plans compliance with plan documents as well as DOL and IRS regulations. Making sure that you have a knowledgeable and qualified employee running the plan will help to ensure operational compliance of the plan. Your auditor will check the plans compliance from a number of perspectives including eligibility of participants, automatic enrollment, vesting eligibility, ineligible participants, etc. A good way to get ahead of any operational issues is to speak with your third party administrator (TPA) and to request the most recent plan documents. Familiarity with plan documents will help the plan to not only operate within the prescribed guidelines, but will help you to manage the plan more effectively and ultimately reduce the auditors time spent on the engagement, saving you money.

Financial reporting is another key aspect to a 401(k) audit. Although you may have experience with filing a 5500 SF, there are certain nuances when you are required to file the long form and attach audited financial statements. The information that will be included in your 5500 and ultimately the financial statements, will generally be derived from certified trust statements (when undergoing an ERISA 103(a)(3)(c) audit, formally known as a “limited scope audit” where the auditor does not audit the certified investments of the plan) or from statements provided by your TPA, which do not contain a certification (this would be a “full scope audit” where the auditor does include investments in their audit procedures.). Your auditor will reconcile information from the financial statements to that contained on the Schedule H of your 5500 as part of their procedures. Although financial statements are prepared in accordance with GAAP, 401(k) audits have specific disclosure requirements that you may not have experience with. Again, your auditor will help you through this process lending their expertise to help you address all crucial areas in the financial statements and footnotes.

What does the typical audit look like?

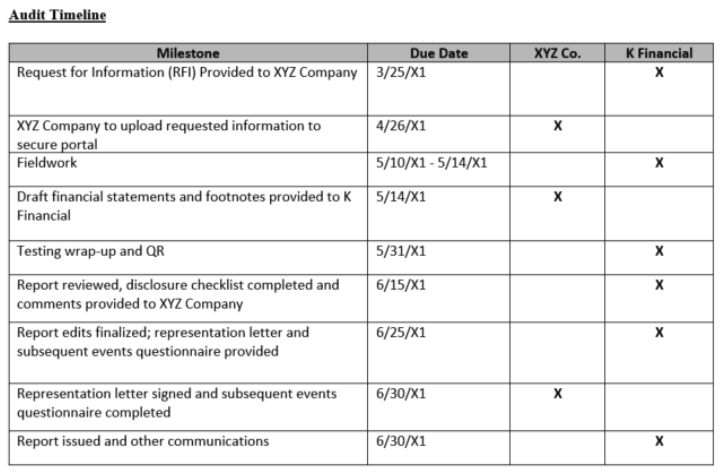

401(k) audits can be executed relatively quickly depending on the size and complexity of the plan. See the theoretical audit timeline for XYZ Company to familiarize yourself with the process.

Planning and audit requests

Like most audits, your auditor will likely start with a planning call or in person meeting to create an audit timeline similar to the one shown above. Once the timing and approach of the audit have been determined, your auditor will communicate an expectation on timing of deliverables. This is generally where new audit clients will require the most assistance and guidance as 401(k) audits are very administratively demanding. Preparing your HR or benefits departments to fulfill audit requests is crucial to a smooth and efficient audit. See the listing of commonly requested audit items below. Although this isn’t a complete listing, it will help greatly to understand the wide range of requests you’ll see during your audit.

Having the auditor’s requests prepared for the beginning of fieldwork is the first step toward a successful 401(k) audit.

Fieldwork:

Once you’ve provided the requested items, your staff will be on standby to assist the auditor with additional requests that may present through testing or to lend their expertise pertaining to payroll, plan operation, or HR. This is the time during the audit that the audit team is hard at work conducting detailed testing of contributions, distributions, investments, loans, etc. While your auditor’s are busy performing their testwork, this is an excellent opportunity for you to begin compiling the financial information you’ll need to draft the financial statements. Being your first audit, it may be beneficial to ask your auditor for an illustrative example of financial statement presentation and/or templates of basic financial statement footnotes.

Reporting:

Once you’ve drafted the financial statements for the plan, you will forward the draft on to your auditor to review and comment on. Although the financial statements are your responsibility as the management of the plan, your auditor will have helpful insights to improving or altering areas in the report. This process is generally quick with a few rounds of comments from you and your auditor, but can vary depending on the complexity of the plan and audit findings.

Issuance:

Once all comments and changes have been addressed and the report has received the approval of plan management, the issuance process will begin. This is the final stage of the audit and will go very quickly. In general, the auditor will provide a few final documents for your review and approval which will include: management representation letter, subsequent events questionnaire, going concern inquiry, etc. After the final documents have been approved, signed, and returned, your auditor will be prepared to issue their final report and required communication with those charged with governance.

What’s next?

You now have a better understanding of the requirements of a 401(k) plan audit and can begin to prepare your own growing company to succeed when an audit is required. Remembering to keep complete and accurate records, maintaining a quality relationship with your TPA, and enlisting the services of a well-qualified benefits plan auditor will greatly contribute to your first successful audit.